PURCHASES

1031 Exchange & Lease-Back with

Quick Close

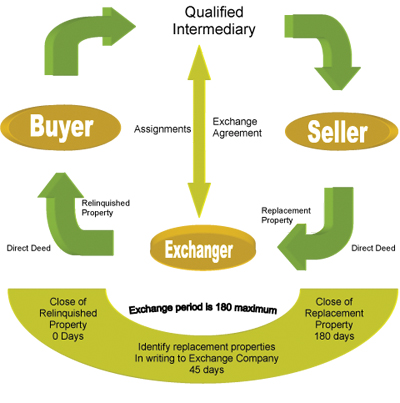

Situation: Buyer needing a 1031 Exchange property to close within a few days. Seller considering if sold for slightly higher than market value with lease back for 1+ year.

Solution: Purchase Agreement finalized on Saturday. Closing arranged with dedicated escrow officer starting early Monday AM. Title issue cleared by 11:45 AM. Conveyance documents notarized by 12:30 PM. Recording accomplished before 1:30 PM cut-off at recorder’s office.

Results: For Buyer —saved over $100,000 in capital gain taxes and acquired an adjacent parcel for future development. For Seller --- sold for over market value with no closing costs. Lease-back without rent for a minimum of 15 months. Both parties very grateful.

Challenges: Determining market value and terms

acceptable to seller and buyer within two days.

Negotiating and signing a purchase and sale agreement

contingent upon a lease-back agreement over a weekend.

Arranging for dedicated escrow officer to exclusively

handle the transaction on Monday AM.

Net Leased Shopping Center - Saratoga Springs, UT

Situation: Family Trust needing 1031 Exchange property

Solution: Screened hundreds of possible properties; negotiated terms on three best options. Signed purchase agreement and closed on selected property. Closed on a net leased out-parcel to Walmart with credit tenants.

Results: 7.25% in-place cap with upside. Immediate 9%+ cash on cash return.

Challenges: Negotiated early renewal with one major creditworthy tenant, which was advantageous for

loan terms.

Multi-Tenant Industrial Partially Leased – Santa Clara, CA

Situation: Family Trust seeking leased light industrial investment with cash flow upside.

Solution: Purchase of multi-tenant building with below market rents and leases expiring within two years.

Results: After one year, net operating income met my projections. After two years, net operating income exceeded my (conservative) pro-forma projections.

Challenges: Creating accurate in-place and pro-forma net operating income projections. Estimating improvement costs. Comparing leasing rates for similar properties and analyzing below market, low market and average market leasing rates to determine purchase price and cash flows for the first two years.